3 PREDICTIONS FOR THE NIGERIAN TECH SECTOR IN 2020

This is the third and final part of my 2020 prediction series. I have previously posted my predictions on the Nigerian recorded music…

This is the third and final part of my 2020 prediction series. I have previously posted my predictions on the Nigerian recorded music industry and film industry respectively. The third string to the bow is the Nigerian tech industry, inclusive of which (for the purpose of this post) is the internet service sector.

So, without further ado, let’s get into the predictions.

Tech Convergence

Almost half a billion dollars has poured into the Nigerian ecommerce (and more recently fintech) spaces since the start of Nigeria’s tech revolution some 8–10 years ago. Since then, the fintechs, particularly those involved in payment facilitation, have been growing from strength to strength, whilst the ecommerce players -despite attracting large investments — have struggled to achieve profitability.

The first reason for this prediction is on the fintech side. Fintech margins will be significantly squeezed in 2020 and beyond. Banks are reducing transaction fees and commissions (as well as loan interest rates due to high Loan Deposit Ratios set by the CBN), and finally seem to have woken up to the threat their digital equivalents are posing. Additionally, new market entrants are also offering aggressive pricing and value-added service offerings to acquire new customers. All these point towards competitive market conditions in this space. And all participants will be looking for unique ways to differentiate their propositions and drive user/transaction growth.

The second reason for this prediction is on the ecommerce side. Nigerian ecommerce businesses have struggled for profitability. This is primarily due to the significant capital expenditures that have to be made to bridge the infrastructure deficit in the country which significantly hinders distribution, transportation and logistics aspects of the business. Additionally, and despite growing user numbers, local ecommerce businesses have not seen the expected move by consumers away from cash (on delivery) payments.

This is primarily a cultural issue that stems from Nigerians’ historical lack of experience/trust in financial-related technologies, which is the cause of the slow adoption of utilising digital channels for completion of payments. This means that ecommerce players need a means of promoting and encouraging the use of cards and other web-based payments channels.

And this leads to the third reason for this prediction. There are growing examples of how the convergence of ecommerce and fintech can work. For example, “Super Apps”, providing ecosystems of applications, with in-built means of facilitating transactions/payments within those ecosystems will increasingly become the norm - see Habari and Opay. Credit/Loan fintechs, such as Migo, Carbon and Branch can also get in on the action by becoming the in-built credit providers of choice in such apps, giving users access to credit to purchase more products/services (but only via the digital payment native to the app, for example). Effectively, such convergence can/will create new, as opposed to merely satisfy existing, demand, and as such will be a major trend for Nigerian tech businesses in 2020.

Broadband Coverage Expansion

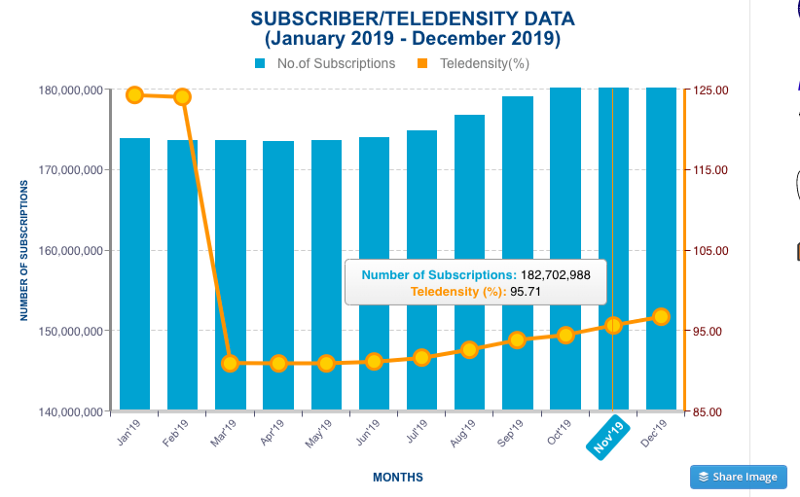

3G network coverage will expand (and begin) to include the estimated 80m people in the country that are currently unconnected/unserved.

The first reason for this prediction is that more backhaul internet connections will be deployed in 2020. There are now 7 “infracos” licensed by the Federal Government (FG) to lay the necessary connections within the country to link with the undersea landing cables that connect Nigeria to the global internet. Despite certain issues with State Governments hindering the speedy progress of some of these companies, the FG’s strong policy position will mean a relatively swift resolution to these challenges.

The second reason for this prediction is that there will be a significant spike in the number of last mile providers particularly targeting the currently un/under-connected areas of the country and segments of the population. As things currently stand only half of the country enjoys 3G network coverage, and coverage areas are relatively concentrated in urban areas. Technologies that make network coverage expansion less capital intensive than traditional means (of towers and base stations or direct cable connections) are starting to be deployed in Nigeria. Last-mile internet providers leveraging on innovative solutions such as renewable energy powered base stations and meshed (decentralised) networks are examples of such. Such internet providers will only increase in 2020.

The third reason for this prediction is the FG’s earlier mentioned strong policy objectives with regards to broadband penetration. These clear policy goals (and accompanying political will) will likely see the FG support the expansion of internet access — particularly to the unconnected and underprivileged — by providing more funding, subsidies, and possibly even some form of regulatory sandbox (like the one developed for fintechs) for those seeking to test/deploy innovative solutions towards resolving the current challenges.

Telcos ‘OTT-ed’

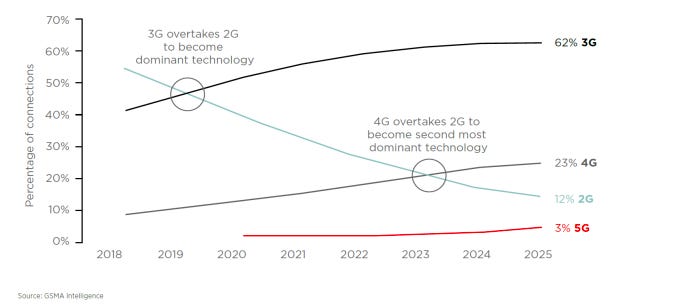

Telecommunications companies (Telcos) will see continued revenue growth from data access revenues but non-core service revenue will continue to decline/flatten in the short term. It is estimated that Telcos have lost over $1b to ‘over the top’ (OTT) services til date.

The first reason for this prediction is the nearing maturity of the telecommunications market in Nigeria. Mobile internet user numbers — at least in developed urban centers around the country — are nearing their peak. Telcos have been enjoying mixed fortunes of late. Despite significant slow down in voice revenues, income from their data (i.e. internet access) services has been growing sharply, with said rises expected to continue over the next few years.

However, on the flip side, their usual additional revenue opportunities have been in major decline. Value Added Services revenues, the biggest single source of additional revenue for telcos over the last 5–7 years, are in free fall. Regulatory developments and consumption shifts have decimated this prior revenue-driver for Telcos — although this decline is now slowly being offset by mobile financial service offerings, albeit these are only in early growth stage.

Historically, value-added services were distributed to subscribers of Telcos directly through the telecommunications network itself. However, with the advent of 3G (and faster) networks — as well as the evolution of digital consumption habits— there is a decreasing reliance on this method of distributing digital content/services. Telcos are increasingly becoming internet service providers and nothing more. Consumers use their networks to access the internet and go on to engage in their various digital activities/transactions without any further involvement from (nor cut to) to the Telcos.

Digital music, film, tv and social communication platforms are increasingly available to consumers over the top of mobile (3G/4G/LTE) networks — in contrast to historical dependency on the network itself to provide access to such value-added content (via GSM/2G). Now, once customers have bought data, Telcos are finding it harder to up/cross-sell additional services whereas once upon a time, they enjoyed secondary and tertiary revenue opportunities.

Of course, Telcos will nevertheless continue to benefit from the growth in adoption of all these OTT products and services. After all, customers still need to buy data to gain access to them in the first place. However, their share of the overall digital economy will flatten and possibly decline unless they are able to successfully develop/acquire additional offerings, such as mobile financial services and premium multimedia content, such as live tv or music streaming.

Conclusion

There is no doubt the Nigerian technology space will continue on its accelerated growth trajectory. However, continued operational losses (on the ecommerce side) and squeezed profit margins (on the fintech side) will necessitate local tech companies in these respective segments to raise more capital and/or create demand to stimulate margins and cash balances. With a lot of money having already flowed into both sectors, more funding alone is not the answer. These businesses will therefore have to find innovative ways to create/stimulate demand for their offerings.

Significant capital is now also making its way into the transport/logistics segments, and this may increase the possibility of further convergence that also includes platforms/services in these respective sectors.

A large part of the demand side of the equation is the width and depth of internet coverage/penetration in the country as well as the increased sensitisation of larger segments of the population regarding how to participate in the digital economy both as a customer and a merchant. The FG’s progress in this regard (in terms of its policy objectives) — as well private sector investment in novel tools/technologies that can democratize internet access services — will have a major impact on the development of the Nigerian tech sector as a whole and growth of the country’s digital economy.

As with my prior two posts in this ‘Predictions’ series, I will also be following these predictions periodically and reviewing them at the end of the year. An exciting year is the offing for Nigerian tech this year. Watching closely to see how it develops.

In the meantime, let me know your predictions for Nigeria’s tech sector in 2020.