Chocolate City Entertainment: Nigeria’s Music OG—Still Kicking or Fading Out?

Two Decades In: Can Chocolate City Keep The Beat?

Chocolate City Entertainment: Nigeria’s Music OG—Still Kicking or Fading Out?

(Two Decades In: Can Chocolate City Keep The Beat?)

Hey L.U.M.I. fam—after we broke down Mavin’s rise, you knew this was coming. Time to check in on one of Nigeria’s foundational labels: Chocolate City Entertainment.

Two decades deep. A catalog that helped script the Afrobeats come-up. Warner Music in their corner. But in this business, legacy doesn’t keep the lights on. The question now is: are they still shaping the game—or just surviving it?

From Kaduna Clubs to Lagos Power Moves

Chocolate City kicked off in 2005, founded by Audu Maikori, Yahaya Maikori, and Paul Okeugo—lawyers and operators who saw early what African music could become. They started in Kaduna, shifted to Lagos, and built a roster that punched way above its weight: M.I Abaga, Ice Prince, Brymo; and later CKay and Blaqbonez.

Today, with Abuchi Ugwu as CEO and Hakeem Bello-Osagie as Chairman, they’re part of a wider group that spans music, events, and digital distribution. The Warner deal in 2019 gave them global lift—and it paid off. But in a fast-moving scene, staying in the game is one thing. Staying relevant is another.

What’s the Money Saying?

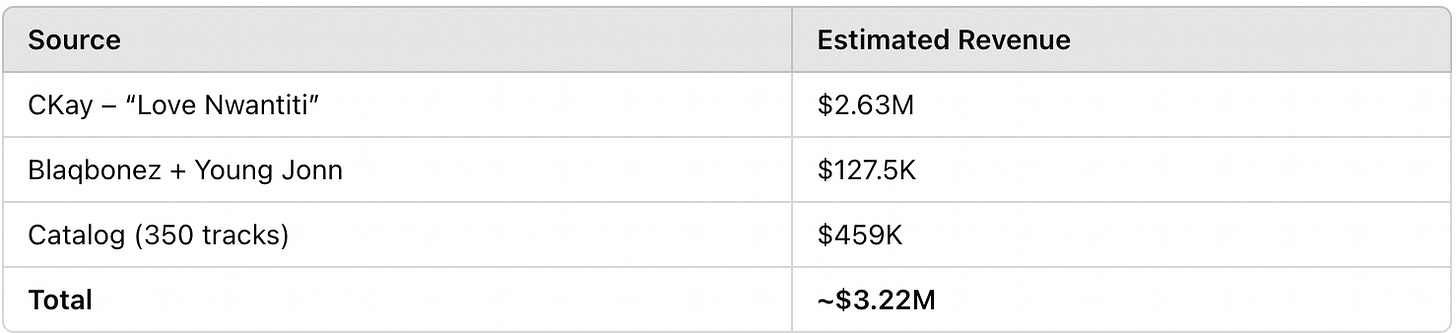

They don’t publish numbers, so we’re piecing this together using streaming data, royalty benchmarks, and real-world assumptions.

The Big Hits

CKay’s “Love Nwantiti” has racked up 938M+ Spotify streams.

Estimate 70% of those are international (avg. $0.004/stream), 30% Nigerian (avg. $0.0015) → ~$2.63M in gross revenue.Blaqbonez’s “Sex Over Love” sits at ~25M streams.

Young Jonn’s “Dada” remix adds another ~26M.

Blend that 50/50 across local and global payouts → ~$127.5K between them.

So, just off the bangers? ~$2.76M.

But what about the back catalog?

What’s the Catalog Worth?

To get a grip on catalog value, let’s build it from the ground up.

Around 14–15 albums released since 2005. Say 12 tracks each = ~180 songs

Add in 150+ singles, features, EP tracks—spanning M.I, Ice Prince, Dice Ailes, CKay, Blaqbonez, and others

That puts the total catalog at ~350 tracks.

If each track averages around 700K lifetime streams, some way higher, most way lower, we’re looking at ~245M total streams.

85% domestic @ $0.0015 → 208M = $312K

15% international @ $0.004 → 36.75M = $147K

→ Total catalog streaming revenue: ~$459K

Total Streaming (2019–2025)

Market Share Angle: Where Do They Stand?

IFPI’s 2025 Global Music Report says Africa’s recorded music revenue crossed $100M, up 22% year-over-year. Nigeria is the lion’s share of that—estimated at 55–60%, or around $55–60M.

Chocolate City’s not dominating like it used to, but it’s still a name that moves weight. Estimating their market share at 6% of Nigeria’s recorded music revenue feels fair. That’s around $3.3–3.6M from streaming and sales.

Now factor in:

30–35 live performances a year, both local and international (roughly 3 a month on average - with bulk likely in December period)

Average show earnings (fees, bookings, appearances): $20–25K → ~$750K–875K

Add revenue from other verticals—licensing, distribution margin, early-stage film/TV bets → ~$500–600K

→ Estimated 2024 revenue: ~$6.9M

With WMG covering distribution and a lean team, a 12% margin is doable → ~$830K in profit.

Still in the Ring—but Still Swinging?

Chocolate City changed the game once. “Oleku” still echoes. CKay’s viral run proved they could play global. But the last few years?

CKay’s now WMG South Africa

Ice Prince is long gone

Blaqbonez has heat, but hasn’t gone global (yet)

Young Jonn’s still building

And they’re competing with:

Mavin, now UMG-backed, cash-stacked, and Rema-powered

YBNL, lean and lethal (next up, soon -hopefully)

DMW, with Davido’s engine behind it

Chocolate City has brand, history, and infrastructure. But that only goes so far. This market moves fast.

So What’s the Play?

The upside is still real:

African music is heading toward $500M+ by 2030

Chocolate City has global infrastructure baked in

There’s talk of film/TV expansion—and they’ve got IP to play with

If they grow revenue 10% YoY, they’re at ~$7.6M by 2025. Use a 5x indie multiple (about right for African market-skewed catalogue compared to 12x-15x in developed markets), and the label’s valuation sits around $34.5M.

But that hinges on:

Signing or keeping the next breakout

Fixing cashflow cycles (still slow in Nigeria)

Smart bets outside core music—without overextending

Bottom Line: Still Here, Still Fighting

$6.9M revenue. $830K profit. ~$3.2M in streaming. $34.5M potential value.

They’re not leading. But they’re not out. And in this market, that’s saying something.

Respect the legacy. But it’s the next move that decides if Chocolate City stays a name—or becomes a memory.