Engineering the Bridge to First Close

A practical playbook for structuring GP survival and capital efficiency before the first LP dollar arrives.

If Saturday’s free essay mapped the terrain — why so many emerging GPs collapse between fund setup and first close — this one builds the bridge.

It’s the operator’s manual for surviving that gap: entity design, funding logic, clause mechanics, and real numbers.

Every framework here comes from actual fund setups across Africa and other frontier markets — refined into templates you can adapt directly.

Intro

The hardest part of building a fund isn’t strategy. It’s survival.

Every GP raising in Africa, Southeast Asia, or the Middle East eventually learns this: you can’t manage capital you don’t yet have, and you can’t raise capital if you’ve already run out of it.

The traditional model offers no bridge between the two.

So the next generation of fund managers has to build its own.

This post breaks down how to do that — step by step.

Not theory. Structure.

How to design your entities, fund economics, and compliance so you can reach First Close without going broke.

Each framework here is drawn from real fund setups — including hybrid structures, cost-recovery clauses, and bridge financing models already in use by emerging GPs.

The goal is simple: stop fundraising on hope, start fundraising on design.

1. The Real Economics of First Close

Every emerging GP faces the same math problem: survival.

Without fees, a fund still needs cash to exist.

Typical lean budgets for African and frontier GPs:

The 2-and-20 model assumes wealth you don’t have.

If your First Close is only 30–50% of target, your fee income won’t sustain operations.

Design your runway instead of guessing it.

Runway (months) = Capital available to GP / Monthly Burn

You need at least 18 months of runway to survive a normal LP cycle.

📂 Paid subscribers can download the First-Close Budget Model on NurHaus (link at the bottom of this Brief).

2. Building the Three-Layer GP Architecture

A single-entity GP is fragile. A structured GP can survive.

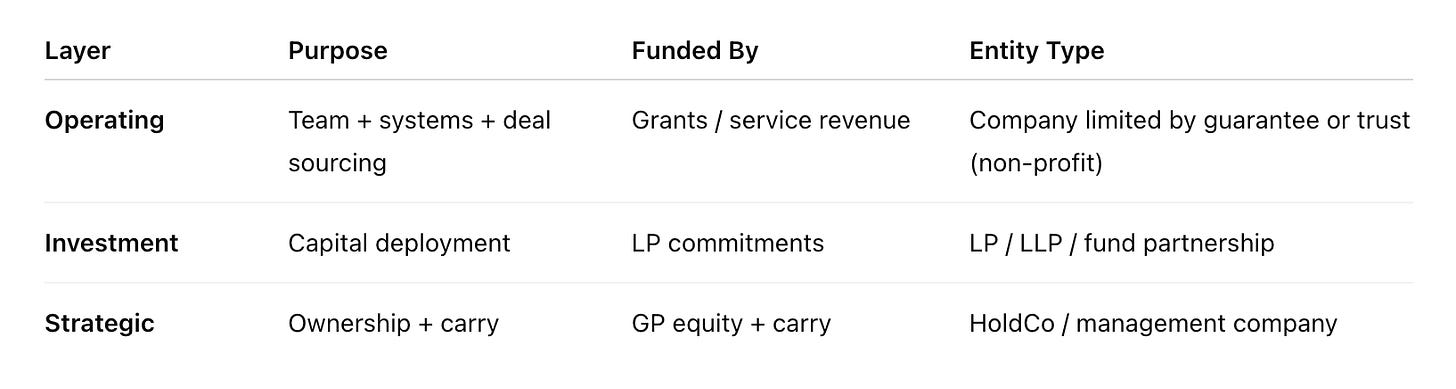

Build around three layers:

Each layer has its own funding logic: grants fund operations, LPs fund investments, carry funds the firm’s future.

Example:

A Kenyan GP used a company limited by guarantee to receive $200k in non-profit grant support while its fund vehicle raised institutional capital. No overlap, no commingling, full compliance.

Separation builds resilience — each layer can survive even if another is delayed.

Continue reading for the financing tools, clause structures, and LP negotiation scripts used by real emerging GPs.