Fintech Fever: Why the African Startup Ecosystem’s Obsession is Misguided

Not all fintech is created equal. Some verticals are overserved, others fundamentally misunderstood. And the smartest capital is already adjusting

There’s a running joke that every African founder wants to “build the Stripe of Africa.”

But it’s not really a joke. It’s a reflection of how reflexive the ecosystem has become.

Across Africa, fintech absorbs an outsized share of startup funding. In 2023, fintech accounted for 43% of all venture capital raised on the continent — a number that’s held relatively steady over the past four years. The next biggest category, e-commerce and logistics, typically lags behind by a margin of 20 percentage points or more.

This investor skew has predictable effects.

Founders chase capital, and capital chases patterns.

So what we’ve ended up with is a startup ecosystem obsessed with fintech, not because all its problems are the most urgent, or its models the most viable — but because fintech looks most fundable.

The result?

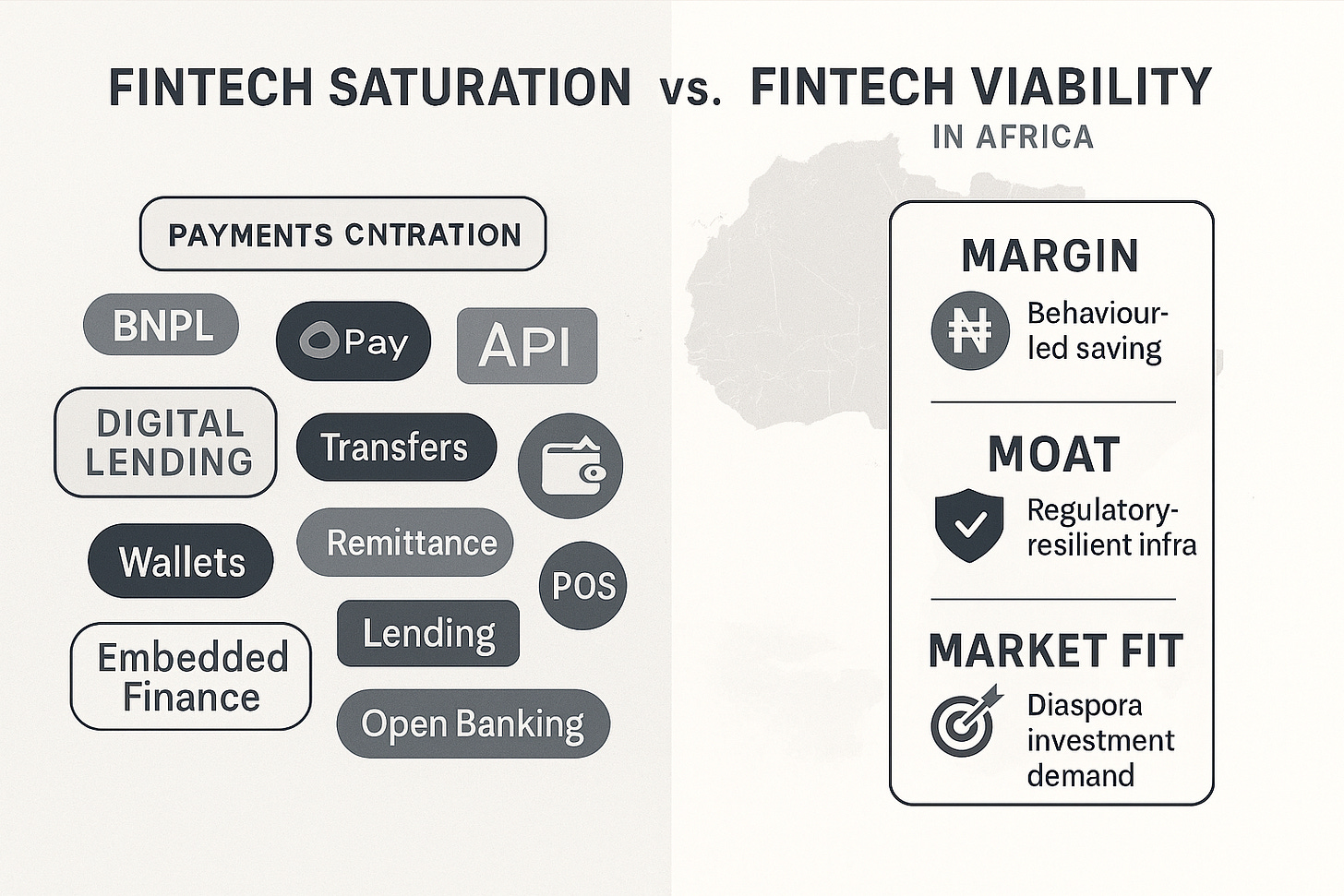

Saturation in some areas, missed opportunity in others, and a flattening of nuance around which fintech models are still worth backing.

The Three Fintech Realities

To properly analyse this, we need to get more precise.

Fintech isn’t one category. It’s a cluster of fundamentally different business models, each with distinct risk profiles, regulatory exposures, and margin potential.

The big three? Payments, lending, and wealth management.

1. Payments: Most Built, Least Profitable

If the number of startups were any indicator of need, payments in Africa would be a solved problem.

In Nigeria alone, the number of active fintechs offering wallets, transfers, merchant tools, or payment APIs is well into the hundreds. Between 2019 and 2023, over 70% of all new fintech licenses issued by the CBN were payments-focused. Some market segments — like agency banking and POS terminals — have reached near ubiquity in urban and peri-urban areas.

And yet, margins remain razor-thin.

Customer acquisition costs are rising.

Price-based competition dominates, and churn is high.

The infrastructure play — “we’re the rails, not the wallet” — is more defensible, but no longer uncrowded. Flutterwave, Paystack, Moniepoint, and even banks themselves have moved aggressively into embedded payment solutions. API startups face regulatory tightening (e.g., PSSP license requirements) and increasingly short runways.

The one real frontier? Cross-border payments.

African remittances still cost an average of 8.9% per $200 sent, nearly three times the UN’s target of 3%. Corridor-specific solutions — particularly into and out of Francophone West Africa, the GCC, or East Africa — remain underexplored. But they also carry FX risk, compliance barriers, and scale limitations.

The honest summary:

Retail payments are saturated. Infrastructure is defensible only at scale.

And unless you solve for corridor-specific compliance or FX arbitrage, new entrants are mostly noise.

2. Lending: Highest Margin, Highest Risk — But Also Most Underserved

By contrast, lending remains one of the few fintech verticals in Africa with real margin potential — but only if you solve for risk in a sophisticated way.

Gross margins in digital lending can exceed 40–50%, particularly where capital is structured efficiently and collections are well-managed. But most players have relied on thin data and shallow behavioural proxies, often resulting in high default rates and regulatory pushback. The FCCPC and CBN have both cracked down on digital lenders in Nigeria for unethical practices, abusive recovery tactics, and privacy violations.

But the deeper issue is structural: the ecosystem still doesn’t know how to identify and underwrite truly creditworthy borrowers — especially those with unstructured or irregular cashflows.

In a formal salaried context, assessing affordability is straightforward. But most economically active Africans operate in informal, variable-income contexts:

A trader whose income spikes during festive seasons

A freelance logistics rider paid weekly via a fintech wallet

A market vendor whose inflows are unpredictable, but whose core expenses are stable and trackable

These are not bad borrowers — just invisible ones.

And the current underwriting methods — airtime top-ups, SMS parsing, prior loan history — barely scratch the surface.

The real opportunity lies in:

Designing flexible repayment schedules that adjust to erratic income patterns — such as grace windows, income-triggered debits, or milestone-based repayment.

Securing visibility over (and access to) all user financial accounts — including both bank accounts and fintech wallets — in order to assess inflows and directly debit repayments when funds are available.

Building machine-readable behavioural profiles from multi-platform transaction trails — even if no single source offers completeness.

In short: credit scoring needs to evolve from fixed salary assumptions to dynamic affordability estimation, based on actual cashflow variability and repayment behaviour.

This is where alternative credit models will either succeed or fail. And it’s the reason we’ll be exploring this segment in a dedicated follow-up post — because it might just be the most important frontier in African fintech.

3. Wealth Management: Nascent Locally, Ripe in the Diaspora

The least explored — and perhaps least understood — fintech vertical in Africa is wealth management.

Locally, it faces obvious headwinds:

High inflation (Nigeria’s food inflation alone exceeded 37% in August 2024)

Low formal employment

Thin savings buffers

Deep distrust of financial institutions

The result is a very short runway for most apps that offer savings, investment, or financial planning.

Even the best-designed product will struggle when the median user doesn’t have enough monthly cashflow to save, let alone invest.

That said, PiggyVest is a clear — and important — exception.

As of early 2025, it reportedly manages over ₦400 billion ($300M+) in user savings, across both core savings plans and investment offerings. It’s one of the few local fintechs that has sustained user trust and behaviour at scale.

But PiggyVest’s traction underscores a deeper point:

It didn’t succeed because of local wealth creation. It succeeded because of behavioral design, cultural familiarity, and rigid discipline tools (automated savings, withdrawal penalties, locked vaults) that align with the lived financial realities of its users — inconsistent inflows, fragile planning, and informal income sources.

In short: PiggyVest worked because it built a product around scarcity, not surplus.

For most others, especially those trying to build investment-first platforms or structured financial products, the local TAM remains limited — especially if they don’t have PiggyVest’s trust equity, behavioural nudges, or first-mover scale.

Which brings us back to where the real short- to mid-term opportunity lies: the diaspora.

Africans abroad remit over $95 billion annually, with Nigeria alone receiving around $20 billion. These users:

Have more disposable income

Are digitally native

Have an appetite for African exposure

But lack access to credible, yield-generating, FX-hedged platforms tied to the continent

This is the overlooked frontier.

Platforms that can solve for trust, compliance, and transparent asset pipelines (property, fixed income, regulated funds) could unlock a more lucrative and underexploited user base — even before local wealth indicators improve meaningfully.

So, Is Fintech Saturated?

The short answer is no.

The better answer is: some parts are, most are misread, and the smartest capital is already recalibrating.

The African fintech opportunity isn’t dead. But the reflexive allocation of money, talent, and media coverage to fintech as a category is long past its expiry date.

Here’s what’s true:

Payments is overbuilt, unless you solve for FX, corridor control, or infrastructure trust.

Lending is high-margin, but demands innovation in data and discipline in collections.

Wealthtech is long-tail locally, but a real, immediate diaspora play — especially if you crack the regulatory and custodial layers.

We don’t need fewer fintechs.

We need smarter ones.

And we need an ecosystem that rewards product logic, not pitch-deck mimicry.

If this resonates…

This post builds on ideas I’ve shared in my recent LinkedIn series on African startup models (20k impressions; 1k+ likes). If you’re interested in how capital, IP, and strategy intersect in African markets — subscribe for future L.U.M.I. Briefs.

Or start with the first LinkedIn post here.

There’s more to come.

— Lumi Mustapha