FLUTTERWAVE’S MONO ACQUISITION: READING THE BALANCE SHEET

When Africa's largest fintech pays in equity instead of cash, the balance sheet tells a story the press release doesn't.

A few days ago, Flutterwave—Africa’s most valuable fintech at a $3 billion valuation—announced it had acquired Mono, Nigeria’s leading open banking infrastructure provider. The deal was structured as all-stock, valued between $25 and $40 million.

To most observers, this was strategic. Flutterwave CEO Olugbenga ‘GB’ Agboola framed it as positioning “open banking as a core pillar of Africa’s evolution.” Abdulhamid Hassan, Mono’s founder, called it a path to “building infrastructure at the speed and scale the continent deserves.”

But here’s what they didn’t say: When Africa’s largest fintech pays in stock instead of cash, it’s not a signal of strength—it’s a signal of arithmetic.

THE DEAL

Mono, often called the “Plaid for Africa,” has powered over 8 million bank account linkages and processes financial data for virtually every major Nigerian digital lender. Founded in 2020, it raised $17.5 million—including a $15 million Series A led by Tiger Global in late 2021.

Flutterwave operates payment infrastructure across 34 African countries, processing $31-34 billion in annual transaction volume. It serves over 1 million businesses, from Nigerian SMEs to global enterprises like Uber and Netflix.

Both are Y Combinator companies. Both backed by Tiger Global. The deal keeps Mono’s operations independent, with Hassan and his team staying in place. On paper, this looks like textbook strategic M&A: payments plus data infrastructure equals full-stack fintech.

The Anomaly

Why all-stock?

Flutterwave raised $250 million four years ago in February 2022 at a $3 billion valuation. For a company sitting on nine figures of venture capital, a $25-40 million acquisition is rounding error.

But Flutterwave paid entirely in equity. Mono’s investors—Tiger Global, General Catalyst, Target Global—received Flutterwave shares, not dollars.

Hassan said publicly that Mono was “not forced to sell,” had “significant cash reserves,” and was “on track to profitability.” If true, Mono didn’t need an exit. Which means either Mono’s investors preferred Flutterwave equity exposure, or Flutterwave needed to preserve every dollar of cash.

In mature tech markets, all-stock deals signal: (1) the acquirer’s stock is overvalued and they’re using it as currency, (2) the acquirer is conserving cash for runway, or (3) shared investors are consolidating portfolio positions to manage markdowns.

Given that Flutterwave raised four years ago, hasn’t announced a new round, and chose stock over cash for a relatively small acquisition, the signal is clear: cash preservation.

To understand why, we need to reverse-engineer Flutterwave’s balance sheet.

THE FORENSICS

The $3 Billion Question

In February 2022, Flutterwave’s valuation tripled in eleven months—from $1 billion (March 2021) to over $3 billion. At the time, the company reported processing $16 billion in cumulative transaction volume across 900,000 merchants.

Revenue disclosure was absent. Based on subsequent data—$30.2 million in 2021, $64.8 million in 2023, and $95.3 million in 2024—Flutterwave’s 2022 revenue was likely $40-50 million.

That implies a valuation multiple of 60-75x revenue.

The question isn’t whether Flutterwave was overvalued in 2022—every late-stage fintech was. The question is: what’s it worth now?

The GMV Illusion

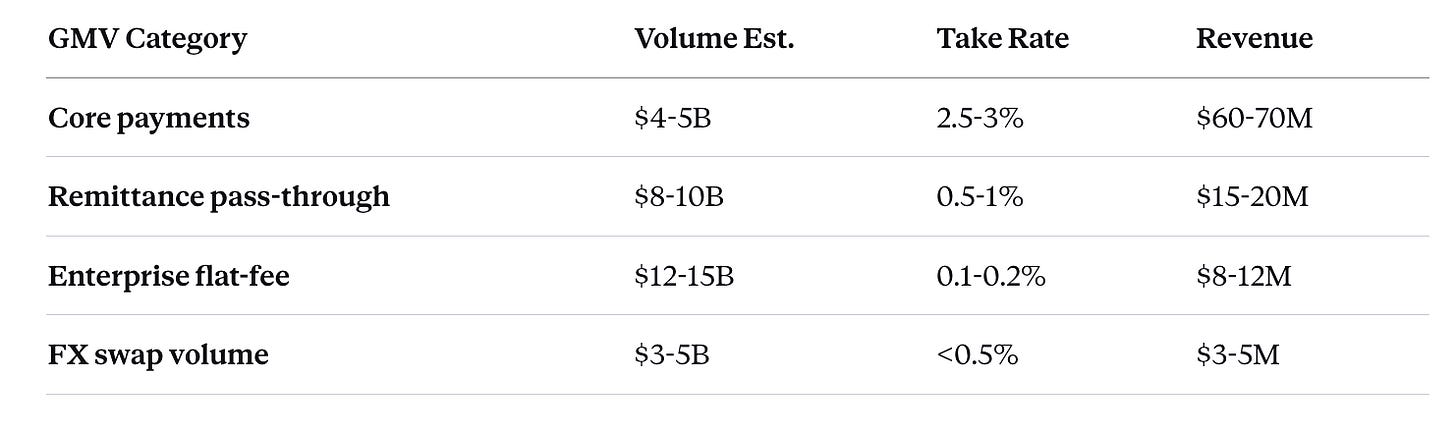

Flutterwave reported $31-34 billion in payment volume for 2024. Against $95.3 million in revenue, that implies a blended take rate of 0.28-0.31%.

Payment processors typically earn 1.5-3.5% on transaction volume. Flutterwave’s disclosed pricing is 2.9% for local cards and 3.8% for international cards. Yet the math suggests they’re monetizing less than one-third of 1% on reported volume.

The reconciliation: most of Flutterwave’s GMV isn’t monetizable at processor rates.

Total: $31-35B GMV → $95M revenue

The “Stripe for Africa” narrative assumed Flutterwave would monetize all volume at payment processor economics. Reality: 85% of GMV is low-margin infrastructure—correspondent banking, remittance corridors, enterprise throughput.

Using EETAM methodology—factoring in digital adoption rates (35-50%), affordability constraints (0.4-0.6x), and transaction frequency (12x/year) across Nigeria, Kenya, Ghana—the realistic monetizable GMV ceiling is $3.5-4.5 billion annually at 25% market share.

Flutterwave’s 2024 revenue of $95 million at a 2.5% blended take rate implies $3.8 billion in actual revenue-driving volume. This aligns almost perfectly with EETAM predictions.

The $3 billion valuation assumed frictionless scaling. The reality is structural constraints on monetization density.

The Runway Calculation

Flutterwave raised $250 million in February 2022. After banking fees and reserve allocation, approximately $200 million was deployed.

That was 47 months ago.

But hidden burn includes: Kenya asset freeze (2022-23), Nigeria fraud incident ($24M unrecovered, Feb 2023), UK subsidiary loss ($2.8M in 2024), and failed M&A exploration costs.

Adjusted net burn: $35-45 million/year → $3-4 million/month

The calculation:

Cash deployed: $200M

Elapsed time: 47 months

Monthly burn: $3.5M average

Burn to date: 47 × $3.5M = $164.5M

Cash remaining (Jan 2026): $35.5M

Runway: 10 months → Nov 2026

Companies begin fundraising when 12-18 months of runway remain. Flutterwave crossed that threshold in late 2024 or early 2025.

Scenario A: Already raised (Q4 2025, undisclosed) — 60% likelihood

Private extension round, inside investors (Tiger, B Capital), structured to avoid public markdown. Valuation: $2-2.5 billion (down 25-33%). New capital: $75-100 million. Mono acquisition used freshly-issued equity.

Scenario B: Raising now (stealth mode) — 30% likelihood

In market for $100-150 million at $1.8-2.2 billion. All-stock Mono deal negotiated during fundraise. Tiger Global consolidates portfolio positions.

Scenario C: Hit profitability — 10% likelihood

CEO stated “profitability target for 2025” publicly. If achieved, runway extends indefinitely. All-stock deal preserves optionality.

The all-stock structure suggests Scenario A or B. If Flutterwave had ample cash, they’d have paid $25-40 million in cash to avoid dilution.

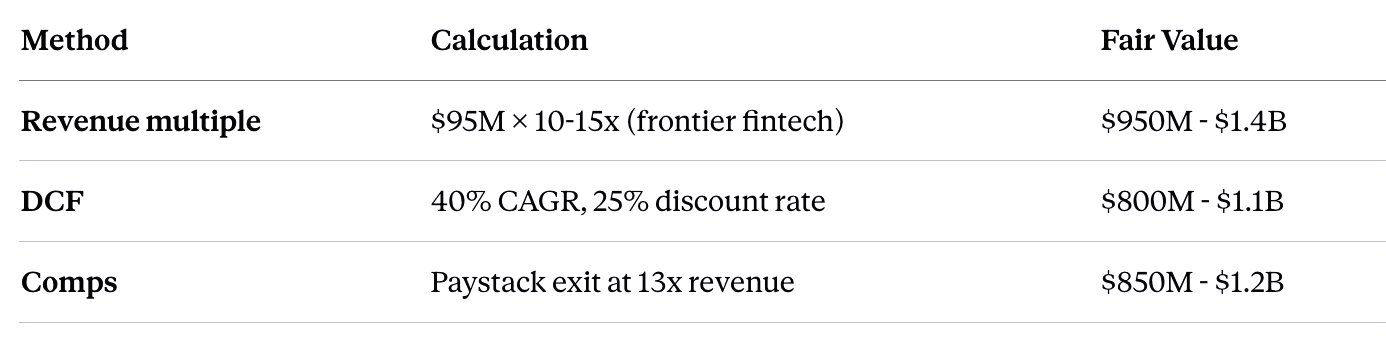

Fair Value

Fair valuation band: $850 million - $1.2 billion

Overvaluation at $3B: 2.5x - 3.5x

The 2022 valuation priced in frictionless African scaling that EETAM constraints make structurally impossible. The down-round isn’t coming—it’s either already happened or is happening now.

THE STRATEGIC DECODE

What Flutterwave Gets

The open banking pitch: account linking (8M+ connections), identity verification, financial data access, and direct debit capabilities. Integrated with payment processing, this creates full-stack infrastructure.

Defensively, most Nigerian digital lenders rely on Mono for credit decisioning data. By acquiring Mono, Flutterwave locks these customers in and blocks competitors like Paystack and Interswitch from owning the data layer.

This is the story for investors: “We’re not just payment processing anymore. We’re building AWS for African fintech.”

What Flutterwave Actually Needs

Strip away the narrative and three motives emerge:

1. Cash preservation

An all-stock deal saves $25-40 million. At $3-4 million monthly burn, that’s 7-12 months of additional runway. For a company 47 months post-raise with an estimated $35 million remaining, those months matter existentially.

If Flutterwave had paid cash, they’d have less than 6 months of runway. All-stock pushes the crisis point from Q2 2026 to late 2026 or early 2027.

2. Revenue acquisition without capital deployment

Mono’s estimated revenue: $5-8 million annually. Adding this to Flutterwave’s $95 million creates a $100-103 million revenue base—crossing the psychological $100M threshold matters for valuation negotiations.

3. Investor portfolio consolidation

Tiger Global led both Flutterwave’s Series C ($170M, March 2021) and Mono’s Series A ($15M, October 2021). Both at peak valuations now underwater.

An all-stock rollup allows Tiger to consolidate two positions. Instead of marking down Mono separately, Tiger converts Mono equity into Flutterwave equity at whatever valuation Flutterwave prices at next.

This is portfolio optimization masquerading as strategic M&A.

What Mono Gets

For Mono’s investors, the deal offers paper exit at 1.5-2.5x their Series A valuation. Early backers see 10-20x returns—on paper.

The caveat: they’re paid in Flutterwave stock valued at $3 billion. When Flutterwave reprices at $1.5-2 billion, those returns compress to 5-12x.

For Hassan and Singh, Mono could have raised another round at $80-120 million valuation. But that round would come in a hostile 2025-26 environment with constraints: nascent Nigerian open banking regulation, costly multi-country licensing, competitive pressure, and valuation ceiling versus equity in “Africa’s largest fintech.”

Mono has partnered with Flutterwave since 2021. Products are already integrated. The question wasn’t “should we partner?” but “should we remain independent or take equity in the inevitable winner?”

They chose certainty over optionality.

The Insider View: Talent Over Valuation

Within African tech circles, a different narrative circulates: talent density matters more than valuation arbitrage.

Hassan and Singh are among the sharpest technical founders in Nigerian fintech. Mono’s 25-30 person team is engineering-heavy. The all-stock structure enables talent retention—pay in equity, keep leadership incentivized, let them build autonomously.

There’s merit here. But if talent were the primary driver, Flutterwave could have hired Hassan and Singh as executives without acquiring Mono, or done a traditional acqui-hire for $10-15M cash.

The $25-40M price tag signals Flutterwave valued Mono’s infrastructure and customer relationships, not just founders. The 8 million bank linkages, lending platform integrations, regulatory licenses—these have tangible economic value beyond team quality.

The talent argument is true and insufficient. Flutterwave acquired both talent and time—and paid in the only currency they could afford: equity.

Does This Actually Fix Flutterwave’s Problem?

What it solves:

Extends runway by 7-12 months (cash preservation)

Adds 5-8% to revenue immediately (optics for fundraise)

Creates product differentiation narrative (full-stack infrastructure)

Blocks competitors from data layer (defensive moat)

What it doesn’t solve:

GMV monetization constraints: Open banking doesn’t increase take rates on existing payment volume

EETAM ceiling: Data infrastructure doesn’t expand addressable market size

Path to profitability: Mono adds $1.7M annual burn (30 employees + integration)

Valuation reset: Market will still reprice Flutterwave at 10-15x revenue (~$1-1.5B)

Mono operates B2B SaaS economics—70-80% gross margins, low infrastructure costs. Flutterwave operates payment processing economics—60% gross margins, infrastructure-heavy, razor-thin EBITDA margins at scale.

Adding Mono improves blended margins slightly, but doesn’t fundamentally alter the fact that 85% of Flutterwave’s reported GMV is unmonetizable at processor rates.

This is a “buy time” acquisition, not a “change trajectory” acquisition.

Mono gives Flutterwave breathing room to close a down-round from narrative strength rather than desperation, or sprint to profitability and avoid raising entirely.

But it doesn’t change the underlying arithmetic. The all-stock structure isn’t strategy. It’s necessity.

THE SIGNAL

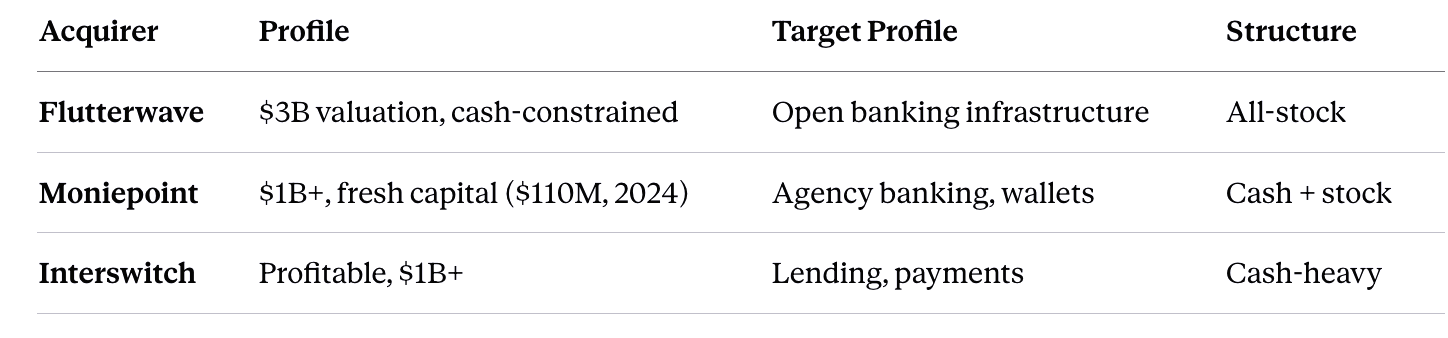

Consolidation Has Begun

The Mono-Flutterwave deal is the opening move in African fintech’s consolidation wave.

Between 2020 and 2022, over $3 billion flowed into African fintech startups valued at 50-100x revenue. EETAM constraints—affordability, digital literacy, infrastructure gaps, regulatory friction—meant scaling took 5-7 years, not 18-24 months.

Now those companies face a choice: raise down-rounds, get acquired, or die.

The next 18 months will see 8-12 acquisitions: Top 3-5 fintechs absorbing Series A/B companies valued at $50-200M that can’t raise growth rounds.

Reading The All-Stock Tell

When you see all-stock deals in fintech, three questions matter:

1. Why not cash? → Acquirer managing runway or has no available capital

Cash deals typically demand discounted valuations. Acquirers pay 20-40% below last funding valuation—protection if integration fails. They structure earnouts: ‘We’ll pay $40M, but $25M upfront and $15M if you hit targets over 24 months.’

All-stock eliminates this negotiation. Mono gets valued at Flutterwave’s current equity price (whatever that becomes), not a discounted cash price.

The tradeoff: Mono’s $25-40M valuation is contingent on Flutterwave’s success. If Flutterwave reprices at $1.5B instead of $3B, Mono’s investors take a 50% haircut. But if Flutterwave hits profitability and IPOs at $4-5B by 2028, they multiply their position.

All-stock = shared destiny, not immediate liquidity.

2. Why now? → Target avoiding worse valuation in 6-12 months

3. Who benefits? → Shared investors consolidating positions to avoid separate markdowns

Flutterwave’s all-stock is a macro signal. Even “Africa’s most valuable fintech” is husbanding every dollar. If Flutterwave—which raised $250M four years ago and generates $95M in annual revenue—can’t spare $25-40M for strategic M&A, what does that say about everyone else?

The runway crisis is industry-wide.

What This Means for Investors

If you’re holding African fintech equity at 2021-22 valuations:

Mark-to-market is here. Expect -40% to -70% corrections through 2026 as companies raise extension rounds or get acquired.

Portfolio concentration beats proliferation. Investors backing 8-10 fintech companies will push for consolidation into 2-3 scaled platforms. Better to own 15% of one $2B company than 8% of five $200M companies burning cash.

Secondary opportunities emerge. Buying Flutterwave or Moniepoint equity at $1-1.5B today could yield 3-5x returns by 2028-29 if they hit profitability and IPO. The risk is binary: enduring infrastructure or acquired at fair value.

The smart capital play: support consolidation through all-stock M&A rather than deploy fresh cash into subscale competitors.

What This Means for Founders

If you’re a Series A/B fintech founder in 2026, three options:

Sprint to profitability — Cut burn 50-70%, focus on 1-2 products in 1-2 markets, extend runway to 2027.

Sell to a strategic (all-stock) — Trade independence for scale. Your $50-80M valuation becomes equity in a $1-2B platform.

Raise the down-round — Expect -40% to -60% from last valuation, liquidation preferences, board changes. Only works if you have path to profitability by 2027.

The Mono playbook: “On track to profitability” + “strong cash position” = negotiating leverage even in a sale. Hassan walked into the deal from strength, not desperation. That’s why Mono keeps independence and leadership intact.

Founders who get desperate—3-6 months of runway, missed milestones, toxic cap tables—get acqui-hired, not acquired.

Consolidation favours the prepared.

THE VERDICT

Is Flutterwave in Trouble?

No. But it’s not worth $3 billion anymore.

Flutterwave has a strong product, real revenue ($95M growing 40%+ annually), genuine scale (34 countries, 1M+ merchants), and a credible path to profitability. The brand as “Stripe for Africa” retains value. The customer base is defensible. The team is world-class.

But the 2022 valuation was 2.5-3.5x inflated. Fair value today sits at $1-1.5 billion using any reasonable methodology.

The Mono acquisition doesn’t change this arithmetic. It delays the reckoning by 9-12 months while improving the narrative for the next fundraise.

What Happens Next

Most likely (60%): Flutterwave closed an undisclosed extension round in Q4 2025 at $2-2.5 billion valuation (down 25-33%). Structure: inside round led by Tiger and B Capital, minimal new capital ($75-100M), used freshly-issued equity for Mono acquisition.

Disclosure timeline: Q2 2026 (announce Q1 performance), Q3 2026 (disclose Q4 2025 round once milestone hit), late 2026 (test IPO appetite).

Alternative (30%): Flutterwave is raising right now in stealth mode. Valuation: $1.8-2.2 billion. Target: $100-150M. Mono deal negotiated during fundraise—Tiger consolidating portfolio positions.

Optimistic (10%): Flutterwave hit profitability in late 2025 and doesn’t need to raise. All-stock deal preserves optionality. Positions for 2027 IPO from strength.

The Bigger Picture

Flutterwave’s story is African tech’s story:

2020-22: Narrative over numbers. “Stripe for Africa” justified 50-100x revenue multiples.

2023-24: Reality over narrative. EETAM constraints, profitability timelines, FX volatility compressed valuations.

2025-26: Consolidation over proliferation. Three to five will survive at scale:

Payments: Flutterwave, Paystack (Stripe), Interswitch

Agency Banking: Moniepoint, OPay

Lending: Carbon, FairMoney (or acquired)

Everyone else: acquired, merged, or dead by 2027.

The Mono acquisition is the first chapter of consolidation—a signal that even the market leader is managing cash, negotiating from reality rather than aspiration, and preparing for a valuation reset.

The Final Read

When Flutterwave paid for Mono in stock, they revealed more than their balance sheet. They revealed where African fintech is headed: not toward the stratospheric valuations of 2021-22, but toward honest reckoning with markets, margins, and mathematics.

The next 12 months will determine whether Flutterwave manages its down-round at $1.5-2 billion, hits profitability, and emerges as Africa’s enduring payments infrastructure.

But one thing is certain: The era of 100x revenue multiples is over. The reckoning is here. And it’s all-stock.

For more deep-dives, non-consensus analysis and quantitative frameworks, subscribe. Lots coming in 2026.

Thank you so much for this well written market insights with actionable steps and reality checks. This is really helpful to myself and Bordawave.

This is such a well written analysis! Thanks for putting it together.