Startup Governance & Control Series (Part 2)

The Consent Trap: How Boilerplate Clauses Stall African Startups

Most African founders don’t lose control in boardroom blow-ups.

They lose it in week three of waiting for a WhatsApp response about a decision they thought they could already make.

The Clause That Looks Harmless — Until You Need to Move Fast

In most African startup term sheets and Shareholders’ Agreements (SHAs), investors request a list of Reserved Matters — decisions the company can’t make without prior consent.

These range from issuing new shares to taking on debt or altering the business model. The idea is to protect investors from unilateral risk.

But in practice, the clause becomes a trap:

You need permission to act.

And that permission can be delayed, withheld, or used as leverage.

Even routine moves — like launching a new product line, signing a large contract, or adjusting hiring budgets — get blocked.

And the cost?

Momentum dies.

Deals slip.

Founders stall.

Reserved Matters are meant to protect value — but in African startup deals, they often destroy speed.

Case Study: When One Consent Killed a $2.5M Deal

A West African edtech startup secured a $2.5M Series A offer.

But her previous SHA required unanimous board consent for any share issuance. Two investors — who collectively held less than 15% — had board seats.

One of them disappeared into “travel mode.” The other pushed back on timing.

The board vote took 6 weeks.

The new investor moved on.

The founder still held 47% of equity. But she couldn’t act, because Reserved Matters were tied to board approval, and those seats belonged to early investors with different incentives.

A Quick Reminder: Board Seats ≠ Shareholder Consent

In Part 1 of this series, we unpacked how board seats and observer rights are used to shape company direction — even without holding much equity.

This post builds on that: it’s not just who sits on your board — it’s what decisions they control.

Many African SHAs conflate Reserved Matters (which often require shareholder approval) with board-level decisions (which require director approval). But when investor directors hold board seats and Reserved Matters require board approval, the two power dynamics converge — and founders get boxed in.

What’s Different in African Markets?

In many African SHAs — especially early-stage or DF-aligned deals — Reserved Matters are:

Vaguely drafted: “material transaction,” “change in operations,” “appointment of key personnel”

Attached to low or absolute thresholds: sometimes requiring 100% of Preference Shareholders or unanimous board consent

Missing safeguards: no “deemed approval” if no response in 7–10 days

Untethered from commercial urgency: no distinction between a $5k and $500k contract

This structure is copied from Western templates, but applied in a context where:

Board meetings are infrequent

Communication is informal (often WhatsApp-based)

Governance enforcement is weak

Local investors may not be incentivized to move quickly

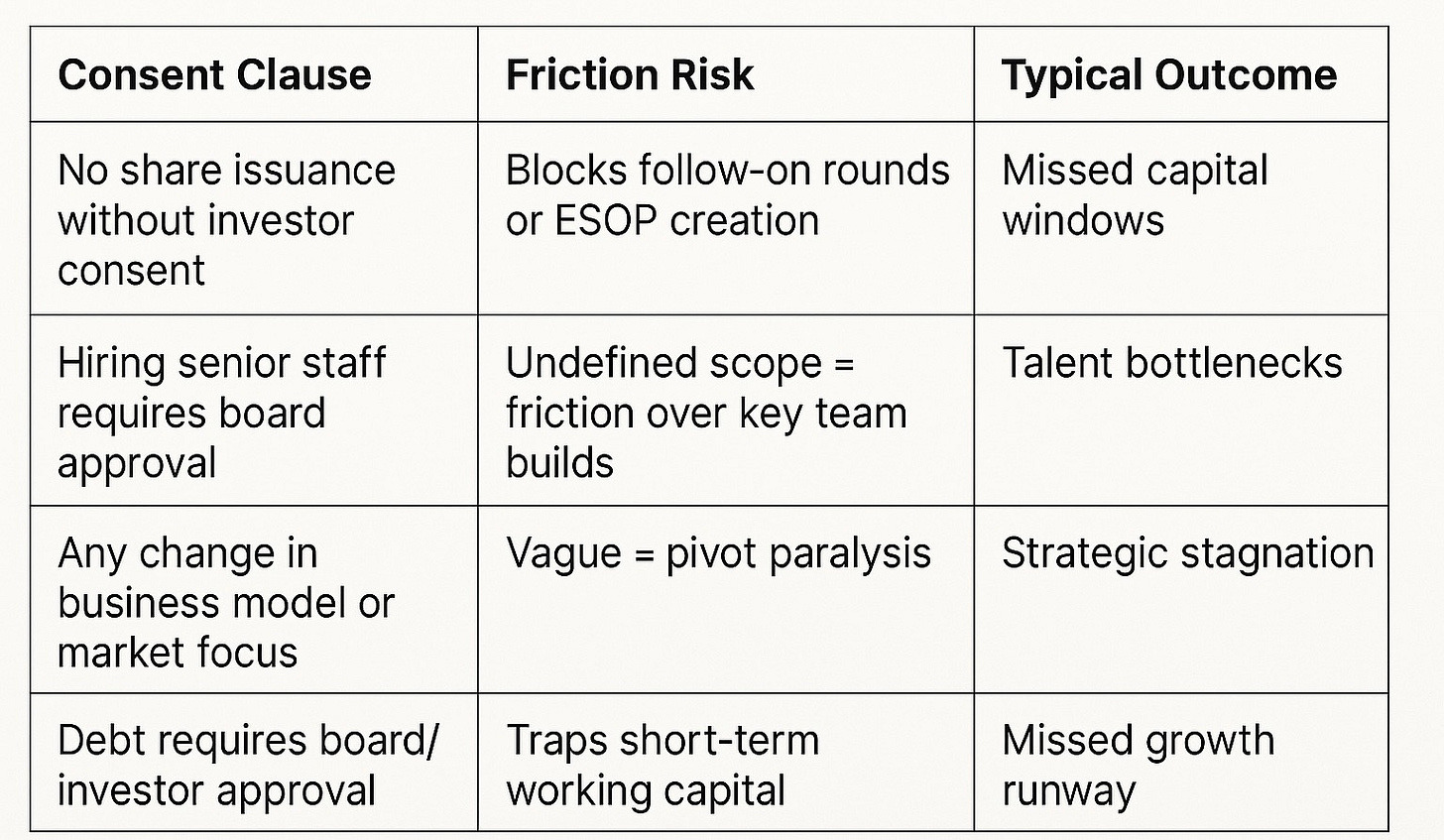

Common Consent Traps in African SHAs

The Circular Trap: Can’t Raise Without Consent — Can’t Get Consent Without Raising

Founders often assume the fix is to bring in a new lead investor.

But here’s the loop:

To raise a new round, you need investor or board consent under the current SHA.

To amend the SHA or restructure governance, you need alignment with those same investors.

But a new lead won’t commit if those governance issues remain unresolved.

This is where African startups get stuck.

Founders become passengers — negotiating both the next deal and the past one at the same time.

What Founders Can Still Do

🔍 1. Map Your Actual Consent Exposure

Distinguish between board-level approval and shareholder Reserved Matters. Know where you’re exposed — and who has the actual power to block or delay.

🛠 2. Propose Time-Limited Consent Clauses

Add or amend clauses that state: If no response within 7 business days, consent is deemed granted.

📨 3. Pre-align Before You Trigger a Vote

If you know an approval is needed, don’t wait for the board meeting. Send a one-pager in advance, answer objections, and build soft consensus before anything formal.

🧾 4. Offer Targeted Waivers for Time-Sensitive Moves

For a specific raise, hire, or expansion — negotiate a limited waiver rather than trying to amend the full SHA mid-round.

📚 5. Document Governance Friction

Keep a simple log: who delayed what, for how long, with what impact. It gives you leverage when renegotiating terms in the next round.

🔒 Want the SHA Clause Redlines, Consent Threshold Templates, and Negotiation Scripts?

That’s in the next LumiBrief Elite post:

✅ Sample Reserved Matters clause rewrites

✅ Deemed approval wording

✅ Governance reset strategies founders have actually used

✅ Board vote sequencing playbook

Final Thought

Most founders don’t know where their company’s real friction sits.

It’s not in the burn rate. It’s in the boardroom — and in the clauses they skimmed, not structured.

You don’t need to rip out governance.

You just need to engineer for speed without surrendering accountability.

📌 This LumiBrief Pro edition is for subscribers only.

To access the full governance toolkit and the SHA redline library, upgrade to LumiBrief Elite.