The Liquidity Pressure Cooker: Why LP Patience Is No Longer a Fund Strategy

Liquidity architecture is fast becoming the new competitive edge for African GPs

“We’re 11 years into a 10-year fund, and distributions are still theoretical.”

That’s an LP speaking—not about a struggling portfolio, but a fund with three exits pending and NAV marked at 2.8x. The companies are performing. The marks look good. But the cash hasn’t moved.

African VC funds hold portfolio companies 2.3× longer than their US peers, yet most fund structures still assume comparable exit velocity. The problem isn’t portfolio quality. It’s that liquidity is treated as something that happens to you, rather than something you design.

When LPs have allocation choices—and in 2025, they do—patience stops being loyalty and starts looking like opportunity cost. The funds that survive will treat liquidity as design, not delay.

The Structural Breakdown

The standard African VC fund operates on a 10-year term with two one-year extensions, targeting 1.5× DPI (cash returned versus cash invested) by year eight.

Reality delivers something different: first meaningful distributions often begin in year nine or ten, with 40% or more of NAV still unrealized when the fund term expires.

Four structural weaknesses explain why:

1. Exit assumptions built for markets that don’t exist.

Most LPAs assume liquidity will come from trade sales or IPOs. Both remain thin in African tech. The acquirer universe is narrow, and IPO markets are functionally closed for venture-scale companies. Yet fund models still forecast exits as if these paths were abundant.

2. Valuation expectations that collapse under diligence.

GPs priced entry rounds to inflated TAMs, assuming broad population reach. Buyers underwrite to the smaller subset with real purchasing power.

A Series B valued at $50M on “100M potential users” gets marked to $80M three years later—then repriced to $25M when acquirers realize only 8M can pay. The MOIC math breaks before the secondary process even begins.

3. Transfer mechanics designed for depth that doesn’t exist.

US-style secondaries assume a deep buyer pool aligned on valuation. In Africa, secondary buyers face the same diligence gap.

When you’re trying to move LP interests, add 75% LP consent thresholds and no standing data infrastructure, and deals die before they start.

4. Recycling provisions with no discipline.

Vague language allows GPs to redeploy realized proceeds indefinitely. LPs experience an extended J-curve as recycling delays distributions, giving the impression that GPs prioritize fee-earning deployment over capital return.

Why LPs Are Done Waiting

LP expectations haven’t changed—just their tolerance for structural excuses.

Institutional allocators now ask “How have you engineered exits?” before they ask about IRR. DFIs benchmark capital efficiency alongside returns.

African family offices and pension funds increasingly demand liquidity terms via side letters—or walk away entirely.

A Nigerian pension fund now requires quarterly liquidity stress tests.

An East African family office negotiated partial in-kind distributions rather than wait for binary exits.

These aren’t outliers—they’re the market correcting for a decade of weak cash realization.

The GPs who assume patience is infinite will lose allocations to those who’ve embedded liquidity thinking from day one.

The GP Liquidity Playbook

Funds that win the next cycle won’t just pick better companies—they’ll build better structures.

Four interventions turn liquidity from dependency into discipline.

1. Secondaries-Ready Clauses

Current norm: 75% LP consent for LP interest transfers. Valuation left to “fair market value” discretion. No data protocols.

Fix: Codify valuation methodology upfront—e.g., trailing 12-month revenue at the 75th percentile of comparable transactions or last round price, whichever is lower.

Maintain a quarterly refreshed data room. Require independent valuation and GP recusal if participating in secondaries.

The LPA can’t override shareholder-agreement ROFRs at portfolio level, but it can remove internal friction around LP interest transfers and GP conflicts.

Signal: This GP thought about my exit before I had to ask.

2. Structured Exit Mechanisms

Current norm: Binary exit assumptions—trade sale or IPO.

Fix: Build partial realization options. Negotiate earn-outs where acquirers pay over time and distribute tranches as received.

Retain minority stakes with put options exercisable in later years.

For cash-generative companies, use revenue participation notes to convert future income into present distributions.

Signal: This GP treats realization as iterative, not all-or-nothing.

3. Staged Monetization Architecture

Current norm: Single liquidity events per company.

Fix: Sell minority positions to growth investors at Series B/C to validate pricing and return capital early.

For later-stage winners, allow LPs to choose between rolling into continuation SPVs or exiting at NAV.

Enable in-kind share distributions or board-level dividend policies.

Signal: This GP prioritizes capital velocity, not terminal value.

4. Recycling Discipline

Current norm: Open-ended recycling with no caps.

Fix: Time-bound recycling to 24 months post-investment period, capped at 25% of committed capital.

Recycle only proceeds from >2× exits and report recycled versus distributed capital quarterly.

Signal: This GP’s incentives align with my need for cash, not just deployment.

These interventions make liquidity a product of design, not luck.

They turn exit outcomes from market timing to structural intent.

Proof of Concept

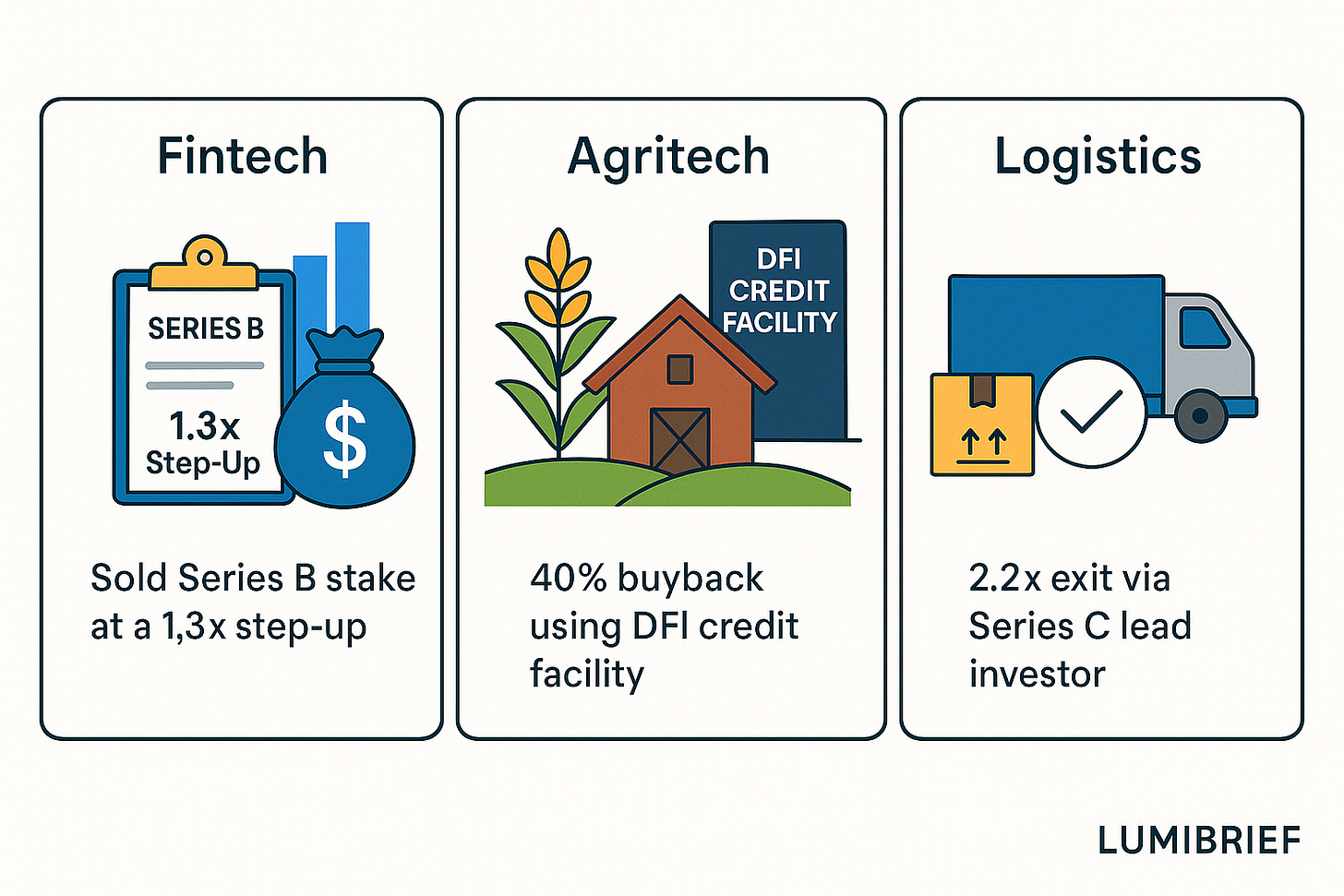

These are not theories—they’re already being executed.

Example 1: In 2023, a Nigeria-focused fintech GP facilitated a Series B secondary sale to a growth equity fund at a 1.3× step-up.

The deal closed in 60 days — far faster than market average — because the portfolio company’s SHA already permitted transfers to approved financial buyers without triggering ROFRs, and the GP had a standing data room plus pre-cleared LPA authority for partial exits.

Example 2: In 2024, a Kenyan agritech company was profitable but illiquid.

The GP negotiated a company buyback of 40% of its stake using a DFI-backed convertible note structure. LPs received 1.8× distributions while the GP retained upside.

Example 3: Also in 2024, a West African logistics platform raised an oversubscribed Series C.

The GP offered LPs a choice: roll into a continuation vehicle or sell at NAV to the incoming lead investor. Sixty percent rolled, signaling confidence. Forty percent exited with 2.2× returns.

Each example reinforces the same truth: liquidity is a design choice.

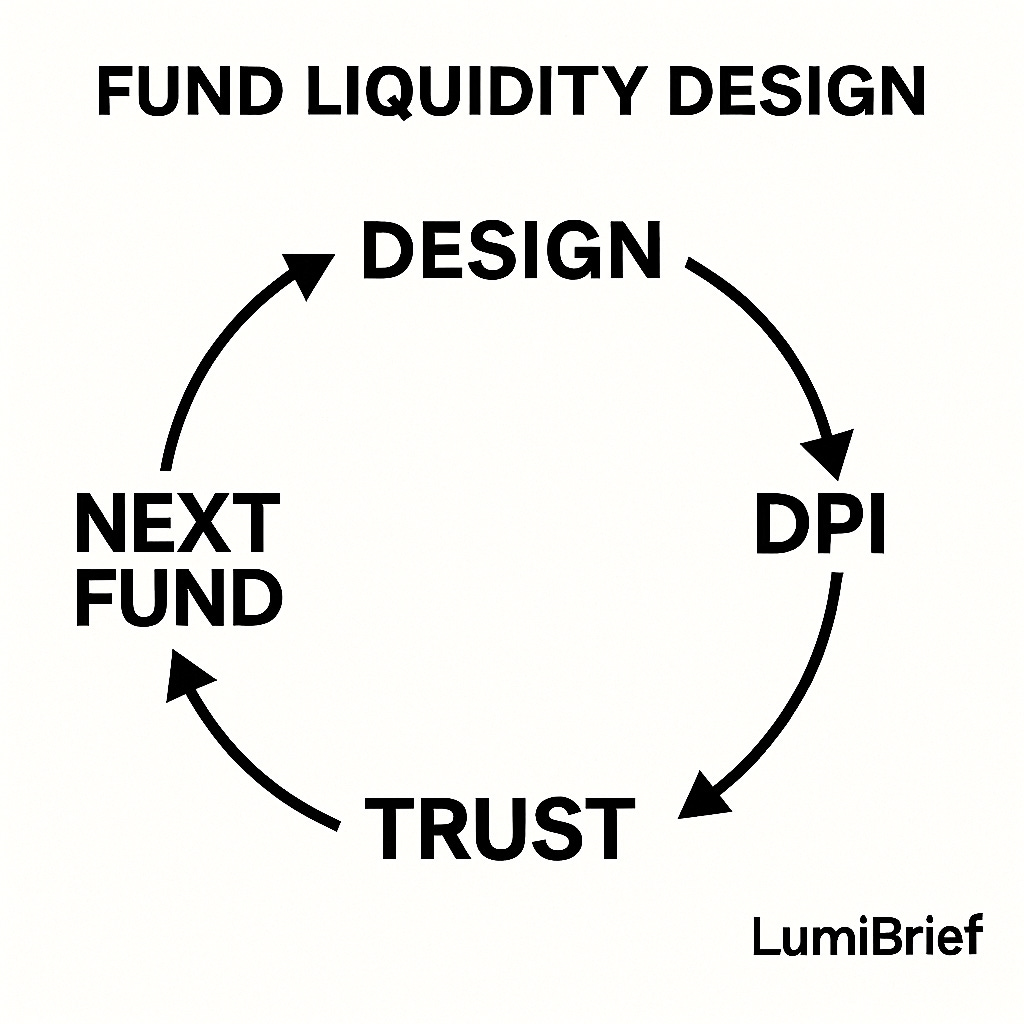

Liquidity as Brand

Liquidity architecture has become a differentiator.

GPs who embed it into fund DNA create a flywheel:

proactive design → faster DPI → stronger LP references → smoother next raise → better deal flow.

With over 50 Africa-focused funds chasing limited LP capital, allocators will consolidate around the managers who solve the liquidity problem.

“How will you get me liquid?” is replacing “What’s your edge?” as the first-meeting question.

The GPs who answer that question with structure—not optimism—will win.

The New Standard

Fundraising used to be about narrative—your track record, your thesis, your network.

The next era is about structure. LPs want proof that liquidity is engineered into your fund before they have to ask.

Capital abundance is ending. LP patience is a depleting resource.

The African GPs who survive the next cycle won’t be the ones with the best stories.

They’ll be the ones who handed their LPs cash.

In the end, liquidity is governance in motion.