Music IP as Collateral: Africa’s Untapped Asset Class

Catalogs already generate steady USD inflows. The missing piece is a framework banks and funds can underwrite.

Banks in Nigeria still default to land and machinery when assessing collateral. The assets they trust are physical — properties, plants, heavy equipment.

Yet music catalogs are producing recurring USD inflows that are measurable, transferable, and in many cases more predictable than real estate yields.

The cashflows exist. What’s missing is a framework to value them.

Anchor Examples

In previous LumiBriefs, I’ve analyzed the numbers behind Africa’s leading catalogs:

Mavin Records: $150–200m

YBNL: $25–40m

Chocolate City: $15–25m

emPawa: $20–30m

These valuations are grounded in real royalty flows and standard financial techniques. But the multiples tell the story: global catalogs trade at 12–20x annual royalties, while African catalogs still sit at 2–4x. Not because the music is weaker — but because the structures and frameworks are.

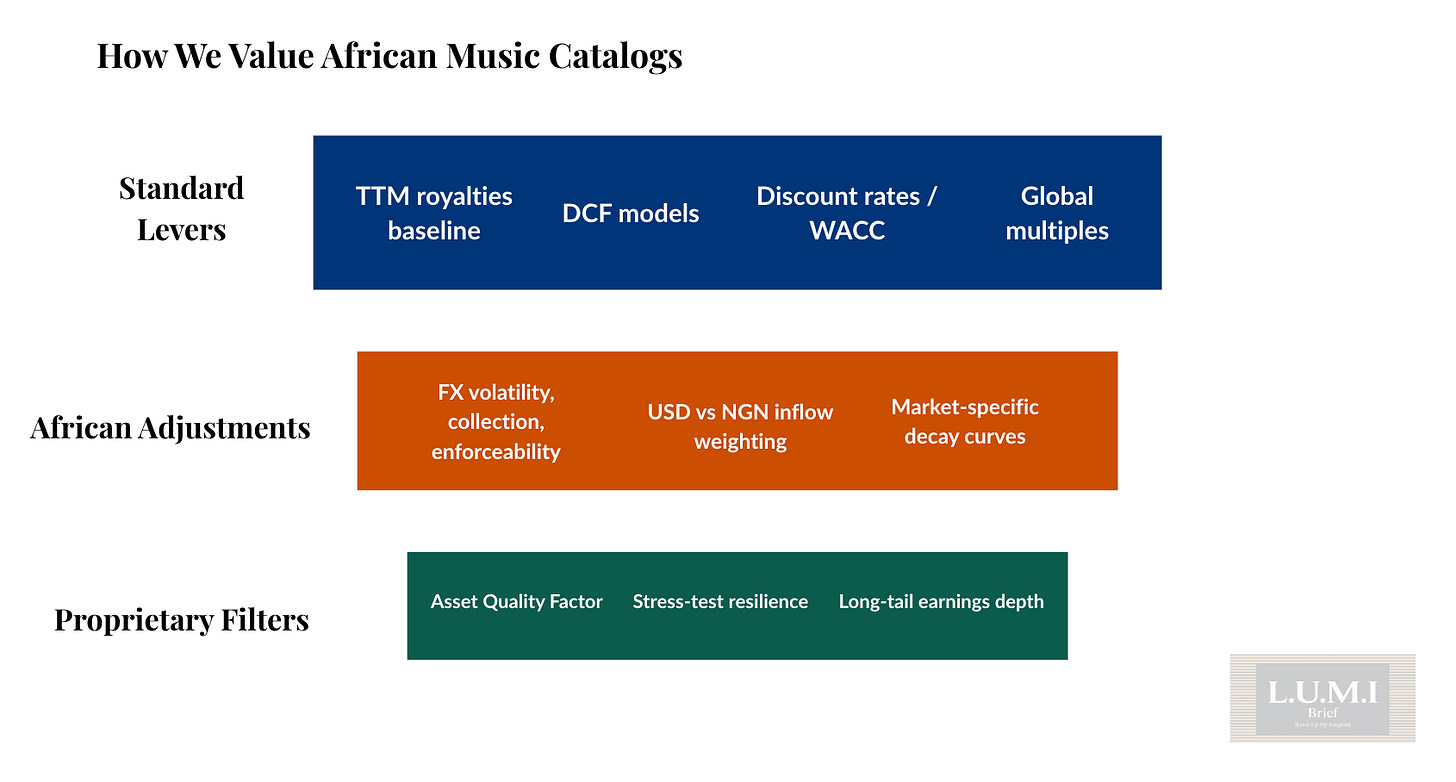

How the Valuations Are Built

The approach combines global standards with Africa-specific adjustments.

Standard levers

Trailing 12 months (TTM) royalties as the cashflow baseline

DCF models projecting future royalties, discounted to present value

Risk-adjusted discount rates and WACC calculations for IP assets

Royalty multiples benchmarked against global catalog sales (eg Queen $1bn, Springsteen $550m, Pink Floyd $400–500m) — discounted for African risk factors

African adjustments

Multiples discounted for FX volatility, collection efficiency, and contract enforceability

Weighting of USD vs NGN inflows — dollar royalties are significantly more bankable

Market-specific decay curves tracking streaming patterns, with sync events resetting growth trajectories

Proprietary filters

Asset Quality Factor: evergreen global hits vs regional short-cycle tracks

Stress-testing catalog resilience under growth stalls or collection delays

Long-tail earnings analysis — 100+ African composers already earn $15k–30k annually in royalties, showing depth beyond superstar catalogs

This mirrors the same toolkit investors use for EBITDA or FCF valuation in operating companies — calibrated for African music IP realities.

And as I’ve written before, publishing rights often prove more defensible than masters: they deliver longer-duration, contract-backed income streams that underpin bankable value.

Market Depth Is Real

Through my work with GLMP, managing ~2,000 works, the pattern is clear: recurring, contract-backed inflows that behave more like annuities than speculation.

These inflows are dollarized, globally consumed, and in many cases more reliable than the rental yields banks continue to over-weight in their portfolios.

The Growth Case for Rights Holders

Rights holders who can capitalize their cashflows unlock reinvestment into:

Additional catalogs, publishing rights, or masters — compounding the royalty base

Strategically aligned revenue streams — eg touring, merch, owned platforms — that reinforce rights-based income

Each layer builds on the others. Current royalties become leverage to acquire future royalties, expanding both cashflows and valuations. This is asset-backed growth, backed by measurable income streams.

The Implication

These conversations are already happening with banks, private equity, and credit funds. And the field won’t remain limited to them: diaspora pools and sovereign wealth vehicles are also well-positioned to underwrite music IP once frameworks mature.

The issue is no longer if music IP becomes collateral — it’s who develops the framework first.

Whoever does will unlock Africa’s next major asset class.

LumiBrief exists to make these dynamics actionable — moving African IP from “interesting” to bankable.

Nice write-up. Was an informative, nice read.

"Not because the music is weaker—but because the structures and frameworks are." Could you provide more clarity on the difference in structures and frameworks across applicable contexts?