Startup Governance & Control Series (Part 7 - Final Part)

The Enabler’s Handbook: Why Africa’s Startup Terms Need Better Builders

Power in African startups is rarely taken — it’s built into the paperwork from the start.

Every veto right, exit clause, and liquidation preference shapes how control flows. These terms aren’t random. They’re designed, approved, and normalized by actors who rarely appear on the cap table — legal counsel, fund managers, investment committees, and institutional LPs.

Fixing governance in African venture isn’t just a founder challenge.

It’s a system design challenge.

Recap: 6 Layers That Shift Power and Value

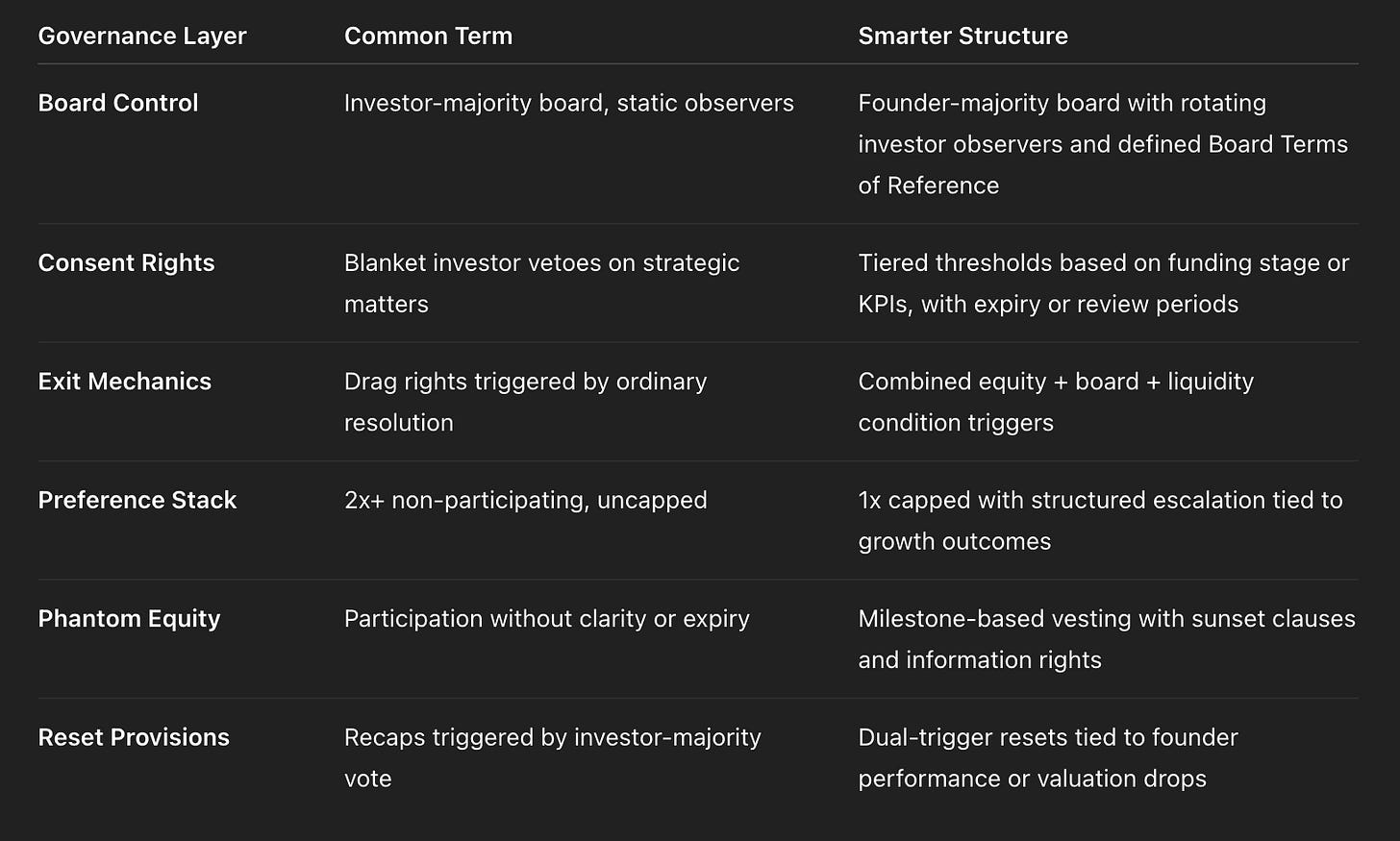

This series has traced how governance shifts happen not through crisis, but structure. What looks like founder failure is often a byproduct of legal mechanics baked into early-stage terms:

Part 1 — Board Dynamics

Founders don’t run the companies they build when they lose control of meeting agendas, voting thresholds, or replacement rights.Part 2 — Investor Consent Trap

Veto rights on ordinary operational matters let minority investors dominate strategic direction.Part 3 — The Equity Illusion

Majority ownership can lose its meaning once voting power, economic rights, and information access are detached from equity.Part 4 — Exit Dynamics

Liquidity events are often triggered by clauses that ignore company readiness or founder alignment — especially drag and put rights.Part 5 — How Founders Lose Economic Control Without Losing Equity

Preference stacks, phantom equity, and ratchets silently divert exit value. Cap tables can mislead.Part 6 — Reset Strategy

Governance resets are possible, but require leverage — often at funding milestones or performance inflection points. Few founders are prepared.

Each of these terms is written long before it is enforced. The outcome isn’t a surprise. It’s a structure.

Who Actually Designs the System?

Founders don’t create the template packs. They work within them.

Legal Counsel

Lawyers set the initial frame — often repurposing foreign templates or favoring lead investors. Where counsel sees “market standard,” founders experience permanent constraint.

Build clause banks suited to African startup realities

Annotate not just what a clause says, but what it does

Move from one-size-fits-all to founder-stage–aligned modular docs

Fund Managers & Investment Committees

Fund managers shape the deal logic. Investment committees approve it. Both decide whether protective terms are used for downside risk — or to consolidate control early.

Score governance health across the portfolio, not just valuations

Normalize consent tiering and founder reset triggers

Align term pressure with stage, not with template

DFIs and Institutional LPs

DFIs fund GPs. GPs set terms. Founders inherit both.

DFI mandates and LPA terms heavily influence the GP’s playbook. Without upstream direction, even “impact-aligned” funds push aggressive governance terms downstream — rationalized as fiduciary responsibility.

Track governance practices in fund audits and impact reports

Encourage use of founder-aligned side letter clauses

Support template development and ecosystem tooling

The influence chain is clear:

DFIs shape GPs → GPs shape terms → terms shape founder outcomes.

Without reform at the top, misalignment remains inevitable at the bottom.

Governance Defaults Are Already Evolving — But Slowly

Better structures are emerging. Founders and lawyers with experience are already negotiating time-limited vetoes, voting-weighted boards, performance-tied resets, and tiered consent rights.

The problem isn’t feasibility.

It’s distribution.

Most founders never see these improvements. They sign what they’re given — often unaware better options exist.

These structures don’t eliminate investor protection.

They make control proportional, timing responsive, and negotiation more transparent.

Why Model Templates Matter

In the U.S., NVCA documents define the institutional standard.

At early stage, the YC SAFE and 500 Startups KISS templates provide fast, founder-aware instruments.

In the U.K., the BVCA suite plays a similar role.

These templates:

Create common expectations

Reduce time and cost

Discourage extractive behavior

Support faster deal velocity

Africa has no such benchmark.

Deals default to foreign documents, PE-style agreements, or investor-drafted markups. Founders — especially first-timers — lack the tools to spot or challenge high-risk terms.

The result is inconsistent protections, prolonged negotiations, and governance structures that don’t match startup stage, risk exposure, or market conditions.

What Africa’s Template Suite Should Include

A shared legal foundation would reduce asymmetry, save legal cost, and improve enforceability across markets.

The suite should cover:

Convertible Notes & SAFEs

With jurisdiction-specific currency, FX, and tax treatmentsShareholders’ Agreements (SHA)

Modular reserved matter tiers, reset mechanics, and performance-based protectionsInvestor Rights Agreements (IRA)

Clear pro-rata, tag-along, audit, and information clausesBoard Terms of Reference (ToR)

Role definitions, decision rules, and observer protocolsVoting Simulators

Excel tools to model board and shareholder outcomes pre- and post-roundClause Commentary Layer

Practical explanations of what each clause enables or prevents — for both founders and junior counsel

The documents should be redline-compatible, editable in Word, and accompanied by regional guidance notes to support adoption in Nigeria, Kenya, South Africa, Ghana, and more.

Who Should Lead the Process?

This isn’t a publishing project. It’s a legal and economic coordination effort — and it needs institutional backing.

The right anchors include:

AVCA — to mobilize fund managers and set adoption expectations

ABAN, VC4A, and founder alliances — to reflect operating realities and ensure founder usability

Bar Associations — to validate enforceability and provide jurisdictional harmonization

DFIs and foundations — to fund template development and require use through mandates and RFPs

Once these templates exist, LPs and GPs can reference them in mandates, founders can request them at first draft, and junior lawyers can advise with more confidence.

That’s how governance becomes a system — not just a scramble.

Final Word: Terms Drive Outcomes

Every clause in a term sheet is a design decision.

It sets the parameters for who decides what, who benefits when, and who holds leverage at key moments.

Founders feel the impact — but they’re not the only ones with agency.

The people drafting, approving, and endorsing these terms shape the incentives across the entire ecosystem. And where those terms remain opaque, misaligned, or one-sided, the result isn’t capital efficiency. It’s stagnation, tension, and avoidable loss.

Better governance doesn’t mean softer terms.

It means structure that reflects the actual risk, maturity, and ambition of the ventures we say we support.

The system is still being built.

We still have the chance to decide how.

🔐 For LumiBrief Pro Subscribers

The Enabler’s Toolkit Includes:

Founder reset checklists

SHA clause redlines

Consent tiering templates

Governance audit scorecard

DFI-aligned side letter inserts

Voting rights simulator (Excel)